Hello everyone!

I’m struggling with the question: how pyfolio estimates risk free rate?

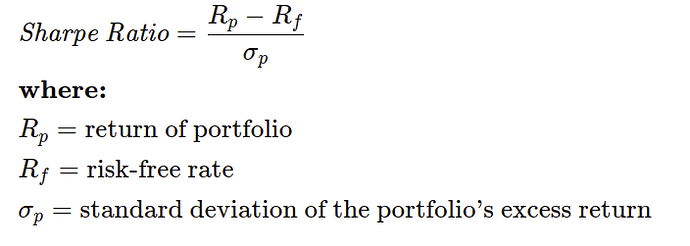

The plot_rolling_sharpe get as input the returns and create a plot of the rolling Sharpe Ratio. According to the Sharpe Ratio definition:

to calculate the Sharpe Ratio we need the risk free rate (e.g. from the benchmark). However, the plot_rolling_sharpe method don’t get any related input.

How Sharpe Rate is estimated? Is it used the average portfolio return as risk free rate?

Thank you very much!

poorest

February 23, 2022, 1:09pm

#2

Which file/folder are you looking at?

I’m looking at this file .

In particular to this piece of code:

If my question is not clear I can try to rephrase.

Thanks!

You can go to the pyfolio-reloaded repository on github and find:

pyfolio/timeseries.py#L1072

It looks like pyfolio assumes a risk free rate of zero.

1 Like

Thanks maartenb! I was suspecting it but I didn’t thought to go and look at pyfolio code documentation

However… this assumption really surprised me