Hi,

I am going through the Github notebooks for chapter 5, and as I ran 02_backtest_with_pf_optimization.ipynb I noticed that the backtesting result is materially different from what is shown in the book.

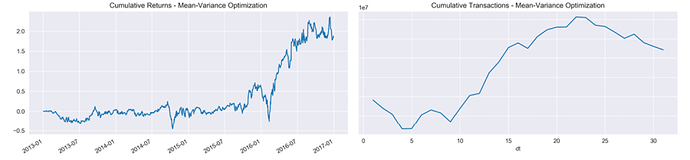

Book:

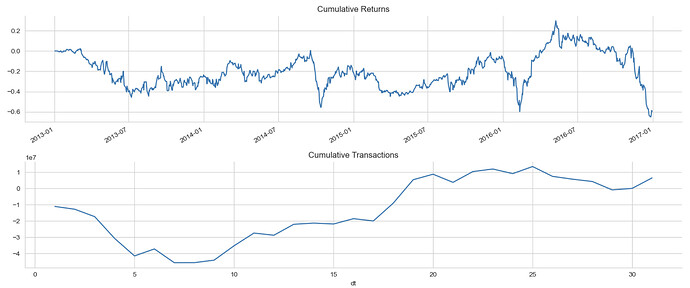

My notebook:

I do notice that the shape of my backtest result is similar to what is presented in the book but:

1- The shapes are similar until 01-2016 where the backtest in the book seems to explode upwards and mine simply ends (although the dates in my backtest coincide with the dates in the book).

2- My backtest seems to be linearly shifted downwards such that most of the series is below 0.

Since presumably the data being used is the same, shouldnt the backtests be the same as well?