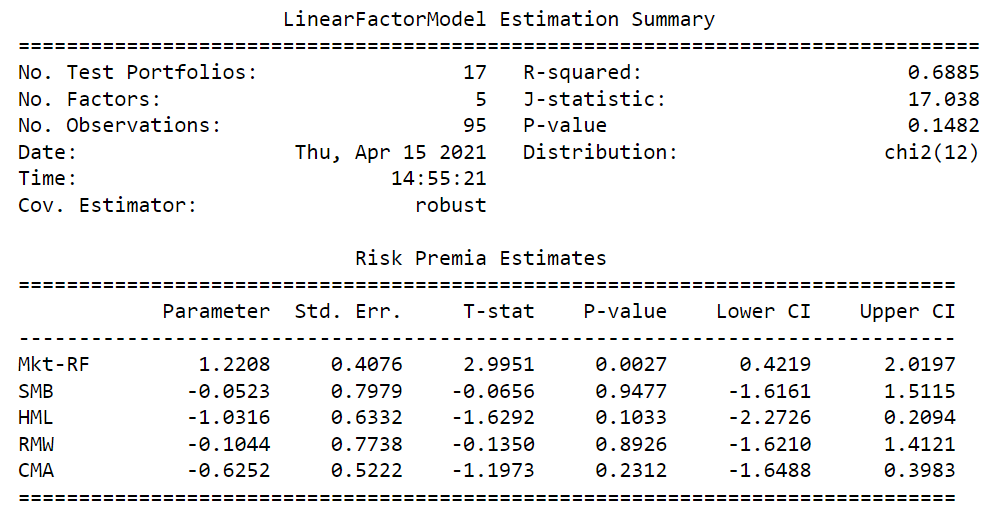

In the following notebook, 07_linear_models/02_fama_macbeth.ipynb, the p-value is insignificant for the fama-french factors except for the market return. Does it mean the portfolio return cannot be explained by these factors? Does this imply the portfolio return can be attributed to the skill of the manager, even though we didn’t include an intercept in the second-step regression?